How to Setup Tax in Magento 2

From this article you will know how to setup TAX for Magento 2 store. In Magento admin there have 3 main areas you need to do attention when configuring TAX.

- Stores > Taxes > Tax Zones and Rates

- Stores > Taxes > Tax Rules

- Stores > Settings > Configuration > Sales > Tax

Let’s follow those configuration by order.

Tax Zones and Rates:

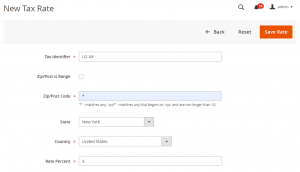

At first you need to create a new tax rate. On the Admin sidebar, go to Stores > Taxes > Tax Zones and Rates and click on the “Add New Tax Rate” button.

Assuming you want to add tax rate for New York with 4% tax. The configuration window as follows:

- Tax Identifier: Fill this field using a unique name. You can write any name here but for better understanding write a meaningful name so you can identify it if you have long list of zones and rates in future.

- Zip/Post is Range: If you enable it you will be able to insert Zip/Post code range. No need to enable it, generally tax rate apply for all over the state or country.

- Zip/Post Code: Keep it “*” to apply this rate for all zip/post codes in selected country and states.

- State: Select state where you want to apply this rate.

- Country: Select country for apply this rate.

- Rate Percent: Fill a decimal value for tax rate that will represent sales tax rate for specific zone.

After all done click on “Save Rate” button for save the configuration. Now you have a tax rate for New York US, for trigger this tax rate you have to create a tax rule. Follow the below tax rules configuration to know how to do it.

Tax Rules:

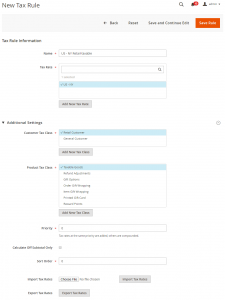

On the Admin sidebar, go to Stores > Taxes > Tax Rules and click on the “Add New Tax Rule” button. Then you will have below screen.

- Name: Fill name with appropriate word to better understanding.

- Tax Rate: Select tax rate that are you created in previous step.

- Customer Tax Class: Select your desire customer tax class for specific customer group.

- Product Tax Class: In Magento each of the products can select only one tax class. Like as “Taxable Goods”.

- Priority: Keep it default value “0”.

- Calculate Off Subtotal Only: Keep it unselected.

- Sort Order: Keep it default value “0”.

- Import Tax Rates: Instead of create tax rates manually you can import bulk of tax rates at a time by importing with proper format.

- Export Import Rates: It is allow you to export all existing tax rates.

After done all configuration click on “Save Rule” button. Now if a customer from New York checkout in your store he will charged 4% tax for taxable product. In the next step you will know how this tax rate calculation will behave and determined how it will display.

Tax Configuration:

If you need to change default configuration of Magento tax see the general tax configuration of Magento.

Sorry, the comment form is closed at this time.